Some Known Details About Pacific Prime

Insurance coverage additionally aids cover expenses associated with responsibility (legal responsibility) for damage or injury caused to a third event. Insurance is a contract (plan) in which an insurance provider compensates another against losses from details contingencies or risks.

Investopedia/ Daniel Fishel Numerous insurance policy kinds are readily available, and virtually any kind of private or organization can locate an insurer happy to guarantee themfor a price. Typical personal insurance coverage types are vehicle, wellness, homeowners, and life insurance policy. Many individuals in the USA have at least among these sorts of insurance, and auto insurance policy is called for by state law.

What Does Pacific Prime Do?

Finding the rate that is ideal for you requires some legwork. Optimums might be established per duration (e.g., annual or policy term), per loss or injury, or over the life of the policy, also recognized as the life time optimum.

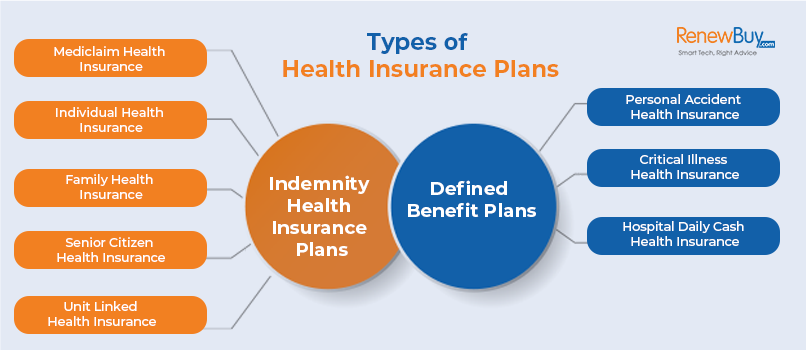

Policies with high deductibles are commonly more economical since the high out-of-pocket expense usually causes less small claims. There are several sorts of insurance. Let's consider one of the most crucial. Health insurance coverage aids covers routine and emergency situation clinical treatment prices, frequently with the option to add vision and dental services independently.

Many preventive services might be covered for cost-free prior to these are met. Health insurance may be bought from an insurance coverage company, an insurance policy representative, the government Wellness Insurance policy Industry, supplied by a company, or federal Medicare and Medicaid protection.

Some Known Incorrect Statements About Pacific Prime

The business then pays all or many of the covered click this costs associated with an auto accident or other automobile damages. If you have a rented automobile or obtained money to buy an automobile, your lender or renting dealership will likely need you to carry car insurance.

A life insurance coverage plan warranties that the insurer pays a sum of cash to your recipients (such as a partner or youngsters) if you die. In exchange, you pay costs throughout your life time. There are two major kinds of life insurance coverage. Term life insurance policy covers you for a certain duration, such as 10 to 20 years.

Insurance is a way to handle your financial threats. When you acquire insurance coverage, you purchase protection against unforeseen economic losses.

The Single Strategy To Use For Pacific Prime

There are lots of insurance coverage policy types, some of the most typical are life, wellness, homeowners, and vehicle. The appropriate kind of insurance policy for you will depend upon your objectives and monetary scenario.

Have you ever had a moment while looking at your insurance coverage policy or shopping for insurance when you've thought, "What is insurance policy? Insurance can be a mysterious and puzzling thing. How does insurance work?

Enduring a loss without insurance coverage can place you in a hard economic circumstance. Insurance is an important monetary device.

The Of Pacific Prime

And in many cases, like vehicle insurance coverage and workers' compensation, you may be called for by regulation to have insurance policy in order to safeguard others - group insurance plans. Find out about ourInsurance options Insurance policy is basically an enormous stormy day fund shared by lots of people (called insurance holders) and taken care of by an insurance coverage carrier. The insurance company uses money accumulated (called premium) from its policyholders and other financial investments to spend for its operations and to accomplish its guarantee to policyholders when they sue

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)